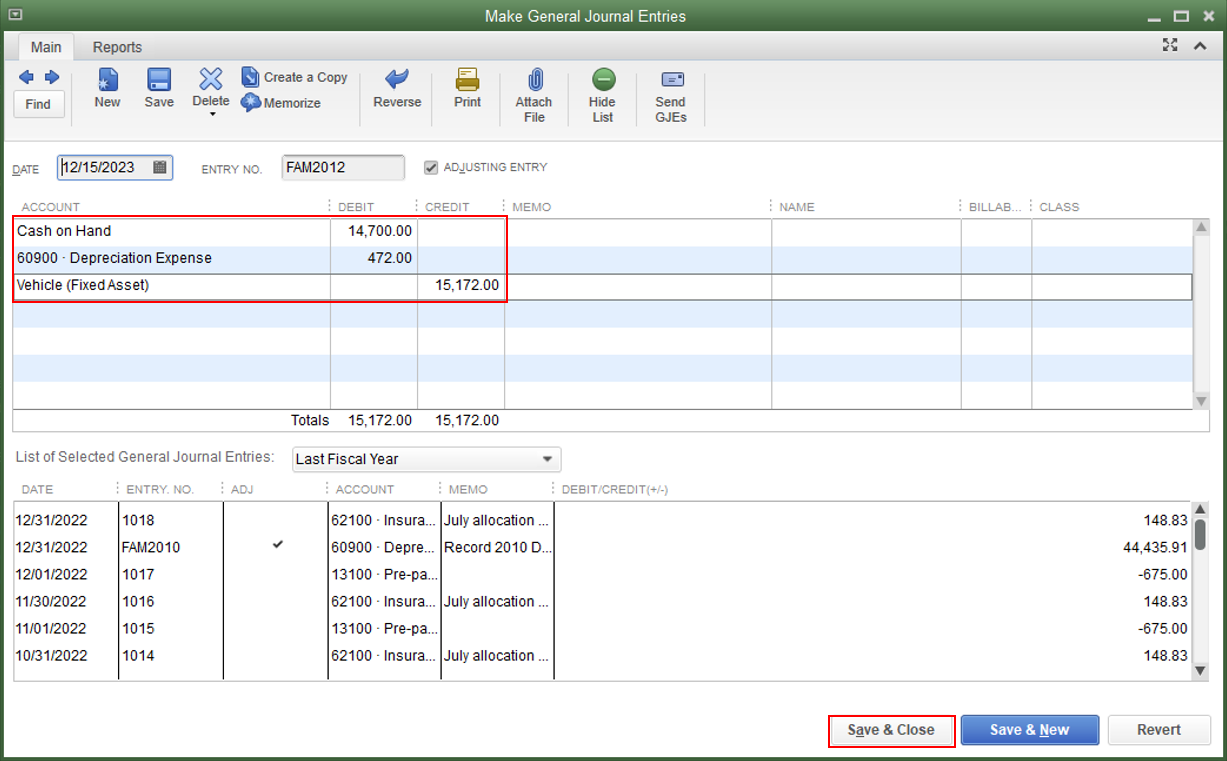

Vehicle Purchase Journal Entry . what about a purchase without a loan (cash) with a trade in. New 2023 vehicle purchase $76,580.70 hst. when entering information for a new company vehicle in quickbooks desktop, a journal entry is often used to. the journal entry is debiting motor vehicles (fixed assets) and credit accounts payable (or cash). on december 2, direct delivery purchases a used delivery van for $14,000 by writing a check for $14,000. There are special rules on how to claim your input tax credits related to a vehicle. check out the bookkeeping entries for the purchase and financing of a vehicle. the initial journal entry for the purchase of a fixed asset on credit is just step one in dealing with the new motor. in quickbooks online (qbo), we can create a journal entry to record the business expense you made with.

from www.wizxpert.com

when entering information for a new company vehicle in quickbooks desktop, a journal entry is often used to. check out the bookkeeping entries for the purchase and financing of a vehicle. on december 2, direct delivery purchases a used delivery van for $14,000 by writing a check for $14,000. the journal entry is debiting motor vehicles (fixed assets) and credit accounts payable (or cash). New 2023 vehicle purchase $76,580.70 hst. the initial journal entry for the purchase of a fixed asset on credit is just step one in dealing with the new motor. in quickbooks online (qbo), we can create a journal entry to record the business expense you made with. There are special rules on how to claim your input tax credits related to a vehicle. what about a purchase without a loan (cash) with a trade in.

How to Enter, Setup Record a Vehicle Purchase in QuickBooks

Vehicle Purchase Journal Entry check out the bookkeeping entries for the purchase and financing of a vehicle. when entering information for a new company vehicle in quickbooks desktop, a journal entry is often used to. the journal entry is debiting motor vehicles (fixed assets) and credit accounts payable (or cash). check out the bookkeeping entries for the purchase and financing of a vehicle. in quickbooks online (qbo), we can create a journal entry to record the business expense you made with. New 2023 vehicle purchase $76,580.70 hst. There are special rules on how to claim your input tax credits related to a vehicle. what about a purchase without a loan (cash) with a trade in. on december 2, direct delivery purchases a used delivery van for $14,000 by writing a check for $14,000. the initial journal entry for the purchase of a fixed asset on credit is just step one in dealing with the new motor.

From dxohbrlsh.blob.core.windows.net

Journal Entry For Car Purchase at Peter Brown blog Vehicle Purchase Journal Entry check out the bookkeeping entries for the purchase and financing of a vehicle. what about a purchase without a loan (cash) with a trade in. when entering information for a new company vehicle in quickbooks desktop, a journal entry is often used to. There are special rules on how to claim your input tax credits related to. Vehicle Purchase Journal Entry.

From financialfalconet.com

Gain on Sale journal entry examples Financial Vehicle Purchase Journal Entry check out the bookkeeping entries for the purchase and financing of a vehicle. on december 2, direct delivery purchases a used delivery van for $14,000 by writing a check for $14,000. when entering information for a new company vehicle in quickbooks desktop, a journal entry is often used to. in quickbooks online (qbo), we can create. Vehicle Purchase Journal Entry.

From www.deskera.com

Journal Entries Explained Full Guide With Examples Vehicle Purchase Journal Entry in quickbooks online (qbo), we can create a journal entry to record the business expense you made with. when entering information for a new company vehicle in quickbooks desktop, a journal entry is often used to. the journal entry is debiting motor vehicles (fixed assets) and credit accounts payable (or cash). check out the bookkeeping entries. Vehicle Purchase Journal Entry.

From www.youtube.com

Merchandising Buyer/Seller Journal Entries YouTube Vehicle Purchase Journal Entry the journal entry is debiting motor vehicles (fixed assets) and credit accounts payable (or cash). New 2023 vehicle purchase $76,580.70 hst. There are special rules on how to claim your input tax credits related to a vehicle. the initial journal entry for the purchase of a fixed asset on credit is just step one in dealing with the. Vehicle Purchase Journal Entry.

From www.slideshare.net

Journal entries of tata motors as on 31st march 2011 Vehicle Purchase Journal Entry the journal entry is debiting motor vehicles (fixed assets) and credit accounts payable (or cash). on december 2, direct delivery purchases a used delivery van for $14,000 by writing a check for $14,000. check out the bookkeeping entries for the purchase and financing of a vehicle. what about a purchase without a loan (cash) with a. Vehicle Purchase Journal Entry.

From www.printablesample.com

13 Free Sample Auto Expense Report Templates Printable Samples Vehicle Purchase Journal Entry the initial journal entry for the purchase of a fixed asset on credit is just step one in dealing with the new motor. There are special rules on how to claim your input tax credits related to a vehicle. on december 2, direct delivery purchases a used delivery van for $14,000 by writing a check for $14,000. . Vehicle Purchase Journal Entry.

From education-portal.com

Journal Entries and Trial Balance in Accounting Video & Lesson Vehicle Purchase Journal Entry There are special rules on how to claim your input tax credits related to a vehicle. the journal entry is debiting motor vehicles (fixed assets) and credit accounts payable (or cash). when entering information for a new company vehicle in quickbooks desktop, a journal entry is often used to. check out the bookkeeping entries for the purchase. Vehicle Purchase Journal Entry.

From katrinagokeray.blogspot.com

Purchase Journal Entry Vehicle Purchase Journal Entry in quickbooks online (qbo), we can create a journal entry to record the business expense you made with. There are special rules on how to claim your input tax credits related to a vehicle. what about a purchase without a loan (cash) with a trade in. New 2023 vehicle purchase $76,580.70 hst. the initial journal entry for. Vehicle Purchase Journal Entry.

From www.autocountsoft.com

AutoCount Accounting Help File 2009 Vehicle Purchase Journal Entry New 2023 vehicle purchase $76,580.70 hst. what about a purchase without a loan (cash) with a trade in. in quickbooks online (qbo), we can create a journal entry to record the business expense you made with. the journal entry is debiting motor vehicles (fixed assets) and credit accounts payable (or cash). the initial journal entry for. Vehicle Purchase Journal Entry.

From www.youtube.com

Journal Entry for Purchase of Inventory YouTube Vehicle Purchase Journal Entry what about a purchase without a loan (cash) with a trade in. on december 2, direct delivery purchases a used delivery van for $14,000 by writing a check for $14,000. There are special rules on how to claim your input tax credits related to a vehicle. New 2023 vehicle purchase $76,580.70 hst. the initial journal entry for. Vehicle Purchase Journal Entry.

From www.youtube.com

Trading a Fixed Asset Journal Entries YouTube Vehicle Purchase Journal Entry check out the bookkeeping entries for the purchase and financing of a vehicle. on december 2, direct delivery purchases a used delivery van for $14,000 by writing a check for $14,000. in quickbooks online (qbo), we can create a journal entry to record the business expense you made with. when entering information for a new company. Vehicle Purchase Journal Entry.

From kikibriancoleman.blogspot.com

how to record hire purchase motor vehicle Brian Coleman Vehicle Purchase Journal Entry the initial journal entry for the purchase of a fixed asset on credit is just step one in dealing with the new motor. on december 2, direct delivery purchases a used delivery van for $14,000 by writing a check for $14,000. the journal entry is debiting motor vehicles (fixed assets) and credit accounts payable (or cash). . Vehicle Purchase Journal Entry.

From dxohbrlsh.blob.core.windows.net

Journal Entry For Car Purchase at Peter Brown blog Vehicle Purchase Journal Entry the initial journal entry for the purchase of a fixed asset on credit is just step one in dealing with the new motor. in quickbooks online (qbo), we can create a journal entry to record the business expense you made with. the journal entry is debiting motor vehicles (fixed assets) and credit accounts payable (or cash). There. Vehicle Purchase Journal Entry.

From www.brainkart.com

Journal entries Meaning, Format, Steps, Different types, Application Vehicle Purchase Journal Entry There are special rules on how to claim your input tax credits related to a vehicle. check out the bookkeeping entries for the purchase and financing of a vehicle. in quickbooks online (qbo), we can create a journal entry to record the business expense you made with. when entering information for a new company vehicle in quickbooks. Vehicle Purchase Journal Entry.

From autosoft.force.com

Making a Vehicle Sales Journal Entry Vehicle Purchase Journal Entry check out the bookkeeping entries for the purchase and financing of a vehicle. on december 2, direct delivery purchases a used delivery van for $14,000 by writing a check for $14,000. New 2023 vehicle purchase $76,580.70 hst. the journal entry is debiting motor vehicles (fixed assets) and credit accounts payable (or cash). There are special rules on. Vehicle Purchase Journal Entry.

From quickbooks.intuit.com

How do I record a fullyowned company delivery vehicle that has been Vehicle Purchase Journal Entry on december 2, direct delivery purchases a used delivery van for $14,000 by writing a check for $14,000. There are special rules on how to claim your input tax credits related to a vehicle. what about a purchase without a loan (cash) with a trade in. check out the bookkeeping entries for the purchase and financing of. Vehicle Purchase Journal Entry.

From www.youtube.com

Vehicle Purchased Through Bank Loan Accounting Entries YouTube Vehicle Purchase Journal Entry check out the bookkeeping entries for the purchase and financing of a vehicle. what about a purchase without a loan (cash) with a trade in. in quickbooks online (qbo), we can create a journal entry to record the business expense you made with. when entering information for a new company vehicle in quickbooks desktop, a journal. Vehicle Purchase Journal Entry.

From ethen-blogeverett.blogspot.com

Accounting for Trade in Vehicle Vehicle Purchase Journal Entry when entering information for a new company vehicle in quickbooks desktop, a journal entry is often used to. on december 2, direct delivery purchases a used delivery van for $14,000 by writing a check for $14,000. what about a purchase without a loan (cash) with a trade in. the initial journal entry for the purchase of. Vehicle Purchase Journal Entry.